Finance

Best Short-Term Online Loans For Bad Credit

Borrowing money is always a tricky decision. If you have good credit, you can likely get a loan from a bank or credit union at a low interest rate. But what if you have bad credit?

There are a number of online lenders that offer short term online loans for bad credit that you can apply with minimal checks, and often get the money you need within a few days.

One of the best things about these loans is that they typically have lower interest rates than traditional loans. This can help you save money in the long run.

But be careful – because these loans are unsecured, you can end up paying a lot of interest if you don’t pay them back on time. So, be sure to only borrow what you can afford to repay.

If you’re looking for a short-term loan to help you get through a tough financial situation, be sure to check out the HonestLoans lenders and those listed below. They are some of the best providers of short-term loans for bad credit.

Table of Contents

How Short Term Online Loans For Bad Credit Work

If you’re in need of a quick loan to cover a financial emergency, you may be considering a short-term loan for bad credit. These loans can be a great solution in a pinch, but it’s important to understand how they work before you apply.

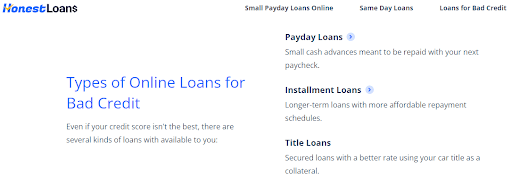

Short term loans for bad credit are typically unsecured loans, meaning you don’t have to put up any collateral to receive the loan. This makes them a great option for people who may not have enough collateral to secure a traditional loan.

The downside of unsecured loans is that they typically come with higher interest rates than secured loans. This is because the lender is taking on more risk by lending to someone with a poor credit history.

Despite the higher interest rates, short term loans for bad credit can still be a great option in a pinch. If you need a loan to cover a sudden expense, such as a medical bill or car repair, and you can’t afford to wait for a traditional loan to be approved, a short term loan may be the best option for you.

Just be sure to carefully read the loan terms and conditions on HonestLoans, and be sure you can afford to repay it on time. Otherwise, you may end up with a lot of added interest and fees.

What Do I Need To Obtain Short Term Online Loans For Bad Credit

There are many reasons why you might need a short-term loan. Unexpected bills, car repairs, or a medical emergency are just a few of the reasons why people might need to take out a short-term loan. If you have bad credit, you might think that it’s impossible to get a loan. However, there are lenders on HonestLoans who offer short-term loans for bad credit.

Before you apply for a short-term loan, you should make sure that you meet the lender’s requirements. In most cases, you will need to be at least 18 years old, have a valid ID, and have a job or other source of income. You will also need to have a checking account in good standing.

When you apply for a short-term loan, you will need to provide some basic information, including your name, address, phone number, and email address. You will also need to provide information about your income and your credit history.

The lender will review your application and decide whether or not to approve your loan. If you are approved, the lender will deposit the money into your checking account. Be sure to read the terms and conditions of the loan before you agree to the loan.

If you need a short-term loan, be sure to compare the rates and terms offered by different lenders. Don’t agree to a loan that is unrealistic or that has high fees. Make sure you can afford to repay the loan on time. If you can’t afford to repay the loan, you might want to consider other options, such as a personal loan or a credit card.

Are Short Term Online Loans For Bad Credit Legit?

When you’re looking for a short-term loan, it’s important to be sure that you’re working with a reputable company. Many people worry that short-term loans are not legitimate, but this is not always the case if you use established online brokers like HonestLoans.

Here are a few things to keep in mind when considering a short-term loan:

First, be sure to do your research. There are many reputable companies that offer short-term loans, so take the time to compare rates and terms.

Second, be sure to read the terms and conditions carefully. Make sure you understand the repayment schedule, and be sure you can afford the monthly payments.

Finally, be sure to contact the lender if you have any questions. The lender should be happy to answer any of your questions, and they should also be willing to work with you to create a repayment plan that fits your budget.

When you’re looking for a short-term loan, it’s important to be sure that you’re working with a reputable company. Many people worry that short-term loans are not legitimate, but this is not always the case. Here are a few things to keep in mind when you’re considering a short-term loan:

First, be sure to do your research. There are many reputable companies that offer short-term loans, so take the time to compare rates and terms.

Second, be sure to read the terms and conditions carefully. Make sure you understand the repayment schedule, and be sure you can afford the monthly payments.

Finally, be sure to contact the lender if you have any questions. The lender should be happy to answer any of your questions, and they should also be willing to work with you to create a repayment plan that fits your budget.

Also, Check – The Easiest Way To Create A Bitcoin Account

Uses Of Short Term Online Loans For Bad Credit

When you are in need of money and your credit score is not good enough to get a loan from a traditional lender, what do you do? One option is to use a short-term online loan. These loans are designed for people with bad credit, and they can be a lifesaver when you are in a hurry to get cash.

There are a few things to keep in mind when you are considering a short-term online loan. First, make sure you understand the terms and conditions of the loan. It is important to know how much you will have to pay back and when the payments are due.

Second, be sure you can afford the payments. These loans can be expensive, so you don’t want to get into a situation where you can’t afford to pay them back.

Finally, be sure to research different lenders to find the best deal. There are a lot of lenders out there, and you want to find one that offers the best terms and rates.

Short term online loans can be a great option when you are in a bind. Just be sure to understand the terms and make sure you can afford the payments.

-

Business3 years ago

Business3 years agoHow to Do Long-Distance Moves with Children

-

Travel2 years ago

Travel2 years agoQuick Guide: Moving To Santa Rosa?

-

Real Estate3 years ago

Real Estate3 years agoWhy Dubai Festival City is a Great Neighbourhood for Young Learners

-

Business3 years ago

Business3 years agoIs Guest Posting a Good Inbound Marketing Strategy?

-

Business1 year ago

Business1 year agoThe Ultimate Guide To Thriving In Your Printing Franchise

-

Business1 year ago

Business1 year agoExploring The Benefits And Challenges Of Restaurant Franchising

-

Tech3 years ago

Tech3 years agoCyber Table That Will Change Your Life

-

Lifestyle1 year ago

Lifestyle1 year agoDallas’ Hidden Gems: 6 Must-Try Restaurants Off The Beaten Path!

Recent Comments