Law

Martha Stewart Insider Trading Charges: Case Overview

Table of Contents

Introduction

Martha Stewart Insider Trading Charges Case Overview is a comprehensive analysis of the criminal case against Martha Stewart for insider trading of ImClone stock. The case is significant as it was the first time the United States government charged the founder of a major public company with criminal fraud. Martha Stewart was the founder of Martha Stewart Living Omnimedia, a media and merchandising company that was publicly traded on the New York Stock Exchange.

In 2001, Martha Stewart was accused of using inside information gained from her broker, Peter Bacanovic, to make a profit on her stock trades in ImClone Systems. She was later indicted on nine counts of securities fraud and obstruction of justice. The case was highly publicized, and the trial drew extensive media coverage. This case overview will discuss the details of the case, the major legal issues involved, and the ultimate outcome of the case.

Overview Of The Case

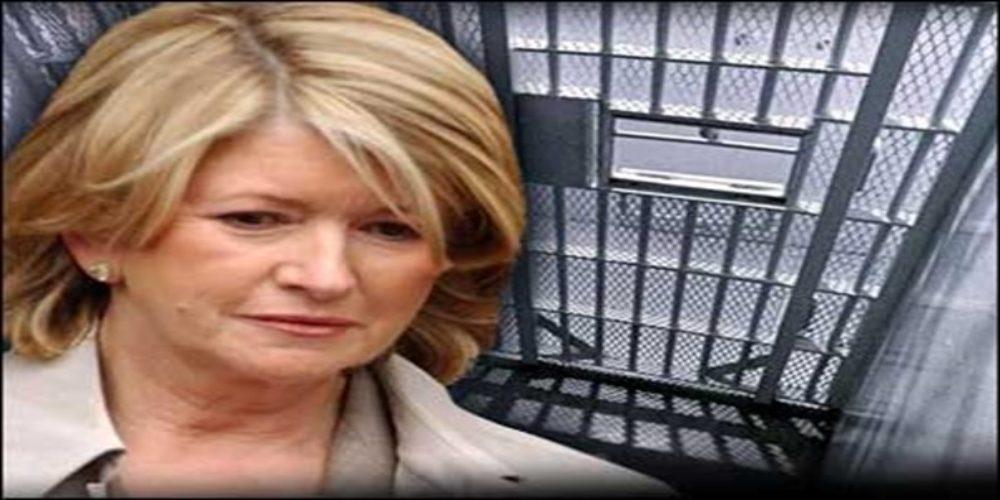

The Martha Stewart insider trading trial of 2001-2004 was one of the most highly publicized corporate crime cases of the early 2000s. The case centered on Martha Stewart, the founder, and CEO of Martha Stewart Living Omnimedia, who was accused of insider trading about her sale of ImClone Systems shares in 2001. Stewart was charged with seven counts of conspiracy, obstruction of justice, and making false statements to federal investigators. Following a five-week trial, she was found guilty on all charges and sentenced to five months in prison. The case raised questions about the level of criminal responsibility of corporate executives and highlighted the importance of compliance with insider trading regulations.

Pre-Trial

The pre-trial of Martha Stewart’s insider trading charges began with an investigation by the United States Securities and Exchange Commission (SEC) into her potential involvement in an insider trading scandal involving ImClone Systems in 2001. The investigation began when the SEC received a tip that Stewart had sold her ImClone stock just before the public release of negative news about the company.

Investigation And Charges

The SEC conducted an extensive investigation into the insider trading allegations. This included interviews with both Stewart and her Merrill Lynch broker, Peter Bacanovic. The SEC also obtained emails, phone records, and financial documents relating to Stewart’s stock sales. After a lengthy investigation, the SEC concluded that Stewart had engaged in insider trading and charged her with securities fraud, obstruction of justice, and lying to federal investigators.

In response to the charges, Stewart and her legal team developed several legal strategies aimed at mitigating the potential penalties and avoiding a criminal conviction. These included arguing that the SEC had failed to prove that Stewart had engaged in insider trading, that her actions were not criminal, and that the government had failed to provide sufficient evidence to support its charges. Additionally, Stewart and her legal team sought to discredit the government’s witnesses and evidence and to demonstrate that Stewart had acted in good faith.

Legal Strategies

Overall, the pre-trial of Martha Stewart’s insider trading charges was a lengthy and complex process that included a thorough investigation by the SEC and the development of several legal strategies by Stewart’s legal team. Ultimately, the case ended with a guilty verdict and Stewart was sentenced to five months in prison and two years of supervised release.

Trial And Verdict

The trial of Martha Stewart for insider trading charges began on January 12, 2004. Before the trial, Martha Stewart was charged with four counts of conspiracy, obstruction of justice, and securities fraud. The U.S. Government alleged that in December 2001, Martha Stewart sold 3,928 shares of ImClone Systems stock, which she had purchased just one day before the stock’s price dropped 16%. The U.S. Government argued that she sold the shares based on material, nonpublic information that she had received from her friend, ImClone CEO Samuel Waksal.

Witnesses And Evidence

During the trial, the Government presented witnesses and evidence to support their case. The witnesses included Douglas Faneuil, a former Merrill Lynch broker who had worked with Martha Stewart; Thomas C. Newkirk, an enforcement attorney with the Securities and Exchange Commission and Peter Bacanovic, the former Merrill Lynch broker who had advised Martha Stewart on the ImClone stock. The Government also relied on emails and a series of phone calls between Martha Stewart and Bacanovic to support their argument that Martha Stewart acted on the inside information when she sold her ImClone stock.

Closing Arguments

The defense team argued that Martha Stewart had been unaware of any insider trading and that her decision to sell was based on a prior agreement between her and Bacanovic to sell if the price of the stock dipped below $60. In their closing arguments, the defense argued that the Government had failed to prove that Martha Stewart had acted on any illegal information, and urged the jury to acquit all four counts against her.

Jury Verdict

On March 5, 2004, the jury issued its verdict. Martha Stewart was found guilty on all four counts of conspiracy, obstruction of justice, and securities fraud. She was sentenced to five months in prison and an additional five months of house arrest.

Post-Trial And Sentencing

In 2004, Martha Stewart was charged with insider trading and obstruction of justice for her alleged involvement in a 2001 stock sale. After a five-week trial in Manhattan, she was found guilty on all four counts of the indictment and was subsequently sentenced to five months in prison, followed by two years of supervised release, including five months of home confinement.

Appeal And Reversal

Following her conviction, Martha Stewart appealed her conviction in the United States Court of Appeals for the Second Circuit. In her appeal, Stewart contended that the prosecution failed to prove that she had traded on insider information and that the trial court had improperly instructed the jury. Despite this, the appeals court upheld her conviction, ruling that the jury had sufficient evidence to convict Stewart.

After the appeal was denied, Martha Stewart was sentenced to five months in prison and two years of supervised release. She was also ordered to pay a $30,000 fine and was prohibited from serving as an officer or director of a publicly traded company for five years. Additionally, she was required to pay $195,000 in back taxes, penalties, and interest to the IRS.

Sentencing And Penalty

In addition to the criminal charges, Martha Stewart was forced to pay a $195,000 civil penalty to the Securities and Exchange Commission for her role in the insider trading scandal. Furthermore, the SEC barred Stewart from serving as a director or officer of a public company for five years.

Ultimately, Martha Stewart was convicted of insider trading and obstruction of justice for her actions in connection to the 2001 stock sale. She was sentenced to five months in prison and two years of supervised release and was also ordered to pay a fine of $30,000 and $195,000 in back taxes, penalties, and interest. In addition, she was prohibited from serving as an officer or director of a publicly traded company for five years and was forced to pay a civil penalty to the SEC.

Conclusion

The Martha Stewart insider trading charges ultimately resulted in her conviction and imprisonment. Her case serves as a warning to those who would consider engaging in such activities, as the consequences can be severe. While her conviction was widely publicized, it should also be noted that the legality of insider trading remains highly contested in terms of both civil and criminal law. Ultimately, the Martha Stewart case serves as a reminder that the law should be respected and followed when it comes to financial matters.

Read more – What Is A Small Claims Court?

-

Business3 years ago

Business3 years agoHow to Do Long-Distance Moves with Children

-

Travel2 years ago

Travel2 years agoQuick Guide: Moving To Santa Rosa?

-

Real Estate3 years ago

Real Estate3 years agoWhy Dubai Festival City is a Great Neighbourhood for Young Learners

-

Business3 years ago

Business3 years agoIs Guest Posting a Good Inbound Marketing Strategy?

-

Business1 year ago

Business1 year agoThe Ultimate Guide To Thriving In Your Printing Franchise

-

Business1 year ago

Business1 year agoExploring The Benefits And Challenges Of Restaurant Franchising

-

Tech3 years ago

Tech3 years agoCyber Table That Will Change Your Life

-

Lifestyle1 year ago

Lifestyle1 year agoDallas’ Hidden Gems: 6 Must-Try Restaurants Off The Beaten Path!

Recent Comments