Finance

I Made Triple My Salary From Investing, And Then Lost Half of My Earnings – Here’s What I learned

Table of Contents

Introduction

The investing hype has only grown in recent years, and despite losing a significant portion of my earnings in the recent market downturn, I didn’t let it discourage me.

Instead, I was determined to become a successful investor. To achieve this, I continued to educate myself and gain experience through hands-on learning. Along the way, I learned that blindly following market trends is not a viable strategy and that proper education and understanding are essential for successful investing.

In this article, I will be sharing practical and informative tips that can help you succeed in your investing journey. If I had known these earlier, it could have saved me a lot of time, stress, and money. I made sure to use a free investment calculator to make accurate estimates. My goal is to provide guidance for those who are just starting out in investing and to help them become knowledgeable and successful investors.

The Best Way to Get Started, Is to Get Started

It may sound silly, but it’s true—just put on your rollerblades and go.

From my experience, you have to sit down, breathe, and get started. There’s no better way. Sure, you’ll learn about stocks and ETFs—but you’ll also get to know yourself. It’ll help you get familiar with the feelings that come with investing. “Good” times to invest all change depending from person to person.

Start with $100 in ETFs or stock. Feel the excitement when you make 10%—and the pain when you lose it. You might start seeing where you can make a profit. You can learn a lot by reading theory—but it comes way more naturally through practice.

Understand your responses when you lose cash. Do you panic? Do you stay calm? How gutted are you? These will all differ from person to person but also change with experience. You’ll learn to control your emotions during investing, mainly because you’ll start understanding the meaning behind a dip or a sudden increase. Investing can really turn your life around.

If you put your savings into stock, which then drops by 10%—you’re likely to start panic selling. Unfortunately, this also means you’ll sell at a very unfavorable time. You must learn to disconnect your emotions and turn to rational thinking. It’s a crucial skill you’ll get with experience. Putting in your savings is no joke, but you can really turn your life around, especially when e.g., you know how to invest 200k and transform it into a million.

With that in mind, don’t look into paper trading—because it won’t give you as much value as you may think. Mark Minervini says paper trading is “like preparing for a professional boxing match by only shadowboxing; you won’t know what it’s like to get hit until you enter the ring with the real opponent.”

Do it consistently—you’ll automate the behavior, take the emotion out of investing, and use the power of “dollar-cost-averaging” when the market is continually going up and down. No one is good at something from the very beginning, I sure know that I wasn’t.

Be Flexible, Start Broad

Got the hang of your feelings and reactions? Great. Let’s dig deeper.

Here’s the thing—when you’re starting, the best thing to do is have a little bit of everything. Instead of buying individual stocks, go for a broad index. Why? Not buying individual stocks means limiting your volatility and improving your diversification.

For example, if you were to invest in MSCI ACWI Index, you’d be investing in over 2,000 biggest companies on the planet. The odds of your capital reaching 0 are close to zero—so the risk in that is low.

Next, you can target individual countries. The most popular ETF in the world is SPY—the index tracking 500 companies from the USA. You can find ETFs for most of the developed countries and emerging markets.

Then you can target individual sectors such as Financials, Energy, or Healthcare.

Finally, you can find ETF tracking subsegments of different sectors, like Fintech companies or Clean Energy companies.

Theme ETFs aim to identify investment opportunities in companies or sectors driven by long-term trends. There are currently 314 theme ETFs available on the U.S. market, with a total of $102.60 billion in assets under management. The average expense ratio for a theme ETF is 0.63%.

It’s like putting your money in—quite literally—a certain theme. You might not know the world’s next hottest e-commerce company—but you can still believe in the industry. For now, your bets could go to Amazon or Alibaba—but this can change drastically in the next 10 years. So, you can invest in an e-commerce ETF instead, and still, come out victorious regardless of whether the two companies survive.

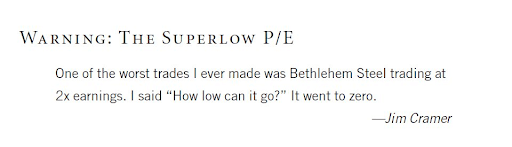

Remember, Don’t Catch a Falling Knife

Learn the basics of fundamental technical analysis. If a stock is in an obvious downtrend—don’t buy it. If a stock is experiencing negative trends—at least wait for a hint or any sign of stabilization. Stocks can fall really hard—and you definitely don’t want to stick around to find out.

For example—when Google stocks fell to $120 from $150, that was the biggest drop of the decade: $120 seemed cheap, and yet, the stock still dropped to below $90. People were so excited, this could even be purchased as a gift. The point is, buying the dip or dollar cost averaging works at the index level—but you need to be careful with the individual stocks as they might keep dropping.

Basically, when investing in an index fund, you are buying into a diversified portfolio of over 100 different funds. This can provide a high level of diversification—which can help to mitigate risk. On the other hand, when you invest in an individual stock, you are only investing in one company. This means that if the stock falls in value, you are more exposed to risk. It’s important to be cautious when investing in individual stocks—there’s a greater chance that the stock could continue to fall in value (potentially even to zero).

For example—historically if S&P 500 were to drop by 10%, it might be a bargain. If it drops by 20%—that would be a sign to dip your toes. But, keep in mind that stocks can go down by 50-60%—so waiting for the downtrend can sometimes be worth it.

It’s not uncommon for people to buy stocks when they already have fallen 80%—because they’re just so cheap. But there’s a saying that any stock that has fallen by 80%–90% is a stock that at one time was 80%—and then it dropped by half.

After you lose 10%, the math starts to work against you. Let’s think about it—if you lose 1%, you will need around 1% to get it back. But when you lose 50%, you will need 100% to get what you lost back. In other words, if you invest $100, and lose 50%—you’re at $50. If the stock then goes up 50% from $50—you’re only at $75. You need the market to go up 100% (i.e. another $50) to get back to $100.

This is because percent losses will compound against you. Once you lose 10%, you’ll need 11%—and once you lose 20% you’re already at 25%. At 90%, you’re done for.

The point is—if stocks are diving, it’s tempting to buy immediately. But if the stocks keep falling sharply, it’s going to be really tough to recoup your losses. You’d better be sure you’re near the bottom before you invest. Easier to do with an ETF than an individual stock—because the falls and rises are less sharp. With today’s economy, being prepared for any downturn is practically a must.

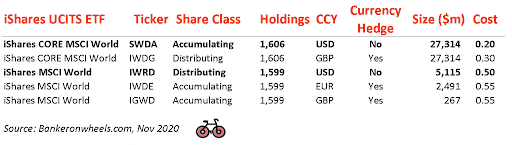

Accumulating vs Distributing

Let’s take a closer look at ETFs and dividends.

So, what exactly are your financial needs? You know better than anyone—and this will help you understand whether accumulating or distributing dividends is the right choice for you.

Some ETFs accumulate dividends—and some distribute them. With the former, your dividends will be automatically reinvested and grow exponentially over time. On the other hand, you get them directly paid out with the latter—giving you a steady passive income.

If you need a future source of income, it may make sense for you to go for ETFs distributing dividends. But if you’re in your 20s and trying to save up for the long term, it would make sense to look into accumulating dividends—they’ll simply compound faster. Remember that you’ll have to pay tax every time you receive dividends.

However, whether an ETF distributes or accumulates its earnings doesn’t have a significant impact on the long-term results for investors.

For example, consider two ETFs named DIST and ACCM—which are both launched on the same day with an initial NAV of €1, and contain the exact same assets. The assets in both ETFs return 10% annually—with 7% as capital gains and 3% as dividends. The ETF named ACCM reinvests the 3% dividend internally by purchasing more of the same assets it already holds—while the ETF named DIST pays the 3% dividend to investors as a distribution.

Also, Check – Surviving The Crypto Winter – How To Push Forward And Become A Better Investor

In the End…

To be a successful investor, one must be dedicated and willing to put in the effort to truly understand the fundamentals of investing, which goes beyond just basic knowledge. It’s important to actively seek out experience, familiarize oneself with emotions and reactions, have a thorough understanding of investments and the market, and not take a passive approach. This process takes time, but being prepared in advance can provide peace of mind and help avoid unexpected challenges. Laziness in investing can lead to negative consequences.

Moreover, investing takes a lot of understanding of yourself, and your finances. This includes knowing how to budget, so you don’t blow all of your money away. Whether it’s using a simple budgeting template or a physical finance diary, you have to know how much money you have and where it’s going.

In conclusion, investing is important and should not be delayed, but once you begin, it’s crucial to continue learning. Continuously educate yourself by reading, asking questions, and growing as an investor. Your future self will thank you for the effort you put in today.

-

Business3 years ago

Business3 years agoHow to Do Long-Distance Moves with Children

-

Travel2 years ago

Travel2 years agoQuick Guide: Moving To Santa Rosa?

-

Real Estate3 years ago

Real Estate3 years agoWhy Dubai Festival City is a Great Neighbourhood for Young Learners

-

Business3 years ago

Business3 years agoIs Guest Posting a Good Inbound Marketing Strategy?

-

Business1 year ago

Business1 year agoThe Ultimate Guide To Thriving In Your Printing Franchise

-

Business1 year ago

Business1 year agoExploring The Benefits And Challenges Of Restaurant Franchising

-

Tech3 years ago

Tech3 years agoCyber Table That Will Change Your Life

-

Lifestyle1 year ago

Lifestyle1 year agoDallas’ Hidden Gems: 6 Must-Try Restaurants Off The Beaten Path!

Recent Comments